nso stock option tax calculator

Moreover employers are required to withhold at least 25 of the spread at the time of the NSO exercise like regular income tax. When public it is based on the stock price.

The exercise price is 12.

. On this page is an Incentive Stock Options or ISO calculator. Learn how Incentive Stock Options are taxed and how to calculate your Alternative Minimum Tax AMT resulting from an ISO exercise using our AMT Calculator. A non-qualified stock option NSO tax calculator estimates your gain in a hypothetical exercise scenario and computes the associated costs.

In the event that you are unable to calculate the gain in a particular exercise scenario you can use the default value of the NSO. Learn how these types of options can benefit employees as. Lets explore what it means to exercise stock options the taxes you may need to pay and the common times people.

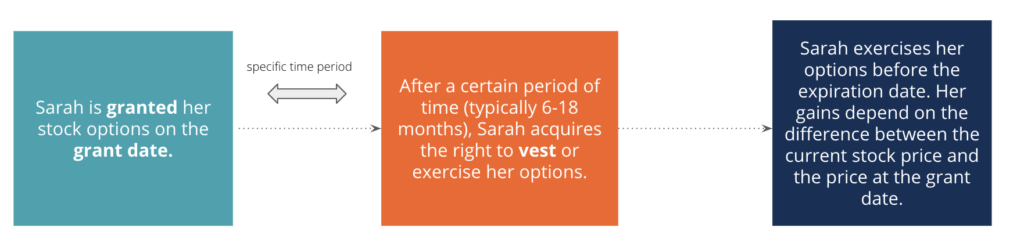

The Lifecycle of a Non-Qualified Stock Option NQSO When private a companys FMV is based on the 409A valuation. Medicare tax 60000 x 145 870. On this page is a non-qualified stock option or NSO calculator.

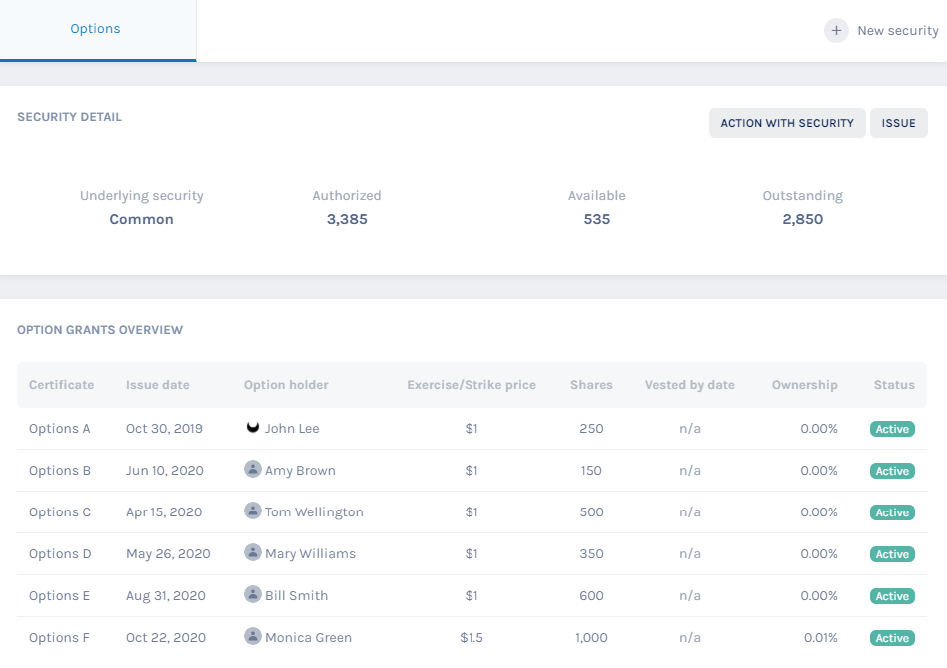

A NSO is a type of employee stock option that gives an employee the right to purchase company stock at a certain price called the exercise or strike price. NSOs taxes are withheld at the time of exercise. This withholding includes federal medicare FICA and.

These are called non-qualified as unlike ISOs NSOs do not meet all the requirements. This calculator can be used to estimate the number of shares you may own after you do a cashless exercise net-exercise of non-qualified stock options. Incentive stock options ISOs which qualify for special tax treatment under the United.

A non-qualified stock option NSO is a form of equity compensation that can be provided to employees and other stakeholders. You exercise the option to purchase the shares and then sell them within a year or less after the day you purchased them. Social Security payroll taxes are equal to 62 percent on earnings up to 137700.

Tools Calculators. A non-qualified stock option NSO is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you exercise the option. How much are your stock options worth.

The Stock Option Plan was approved by the stockholders of the grantor within 12 months before or after the date of adoption of the Plan. It can also show your worst-case AMT owed upfront total tax and its breakdown and the allocation. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net proceeds.

The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two scenarios. This permalink creates a unique url for this online calculator with your saved information. Click to follow the link and save it to your Favorites so you can use it again in the future without having to input your information again.

A non-qualified stock option NSO is a type of stock option used by employers to compensate and incentivize employees. You exercise your options and sell in under one year. Non qualified stock option NSO is one where employees are taxed both while purchasing the stock exercising options as well as while selling the stock.

Stock Option Tax Calculator. You exercise your options and hold at least one year before selling. The calculator is very useful in evaluating the tax implications of a NSO.

This calculator illustrates the tax benefits of exercising your stock options before IPO. It is also a type of stock-based. Please enter your option information below to see your potential savings.

The options were granted within. This amounts to 8000 in ordinary income. Federal tax 60000 x 25 15000.

GRANT Stock options award-ed at. The Stock Option Plan specifies the total number of shares in the option pool. If your earned income already exceeds this amount then youll only pay taxes toward Medicare which is 145 percent.

This earned income is also subject to payroll taxes which include Social Security and Medicare. Abbreviated Model_Option Exercise_v1 -. If the exercise price is 10 and you have 100 NSOs you would pay the company 1000 to exercise your 100 NSOs and the company would give you shares of stock.

NSO Tax Occasion 1 - At Exercise. Add these three for a total of 19590. Calculate the costs to exercise your stock options - including taxes.

Remember you actually came out well ahead even after taxes since you sold stock for 4490 after paying the 10 commission that you purchased for only 2500. Incentive Stock Option ISO Calculator. This permalink creates a unique url for this online calculator with your saved information.

You exercise your options and sell in under one year. The default value of an NSO is 20 per share. Youve made a 81 net gain on your NSO 150 52 sale tax 17 exercise cost If you sell all of your 15000 NSOs then.

NSOs do not require employment and the expiration date can be extended well over 90 days although they do not come with the same favorable tax benefits as ISOs. Using this option employers benefit from tax deductions but employees end up paying higher taxes. An NSO gives recipients the choice to purchase a companys stock at a predetermined price which can be profitable if the stock price rises above that level.

This explains why employee stock options are a type of deferred compensation used to motivate and retain employees. On this page is a non-qualified stock option or NSO calculator. Social Security tax 60000 x 62 3720.

Typically tax is withheld for Social Security on the exercise of NQSO if your gross income is under the annual limit. Calculate the number of shares required to perform a cashless sell-to-cover exercise. Stock options are one of the most common forms of equity compensation that a company can use to incentivize its workforce.

You can find a general overview of stock options in this articleWhen a company issues options to US employees there are two types it can choose from. The Stock Option Plan specifies the employees or class of employees eligible to receive options. The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two scenarios.

You exercise your options and hold at least one year before selling. When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share of company stock. ISOs are attractive due to their preferential tax treatment but employers are.

Abbreviated Model_Option Exercise_v1 - Pagos. Divide the associated costs by the current share price. January 29 2022.

ISOs which come with special tax benefits holders of non-qualified stock options are required to pay taxes based on the price of the stock at the time when the options are exercised. Our calculator allows you to estimate with our without Social Security. A stock option is a right to buy a set number of shares of the companys common stock at a set price the exercise price.

The Ins Outs Of Stock Options In Moneytree Plan Moneytree Software

Stock Options 101 The Essentials Mystockoptions Com

How Much Are My Options Worth Eso Fund

How Stock Options Are Taxed Carta

When Should You Exercise Your Nonqualified Stock Options

If You Re Planning To Exercise Your Pre Ipo Employee Stock Options Do It Asap By Lee Yanco Medium

Tax Planning For Stock Options

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

Get The Most Out Of Employee Stock Options

Non Qualified Stock Option Nso Overview How It Works Taxation

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

Nso Or Non Qualified Stock Option Taxation Eqvista

How Stock Options Are Taxed Carta

Non Qualified Stock Options Explained Plus What They Mean For Your Company S Taxes Warren Averett Cpas Advisors

Non Qualified Stock Options Nsos

Nonqualified Stock Option Nso Tax Treatment And Scenarios Equity Ftw

Qualified Vs Non Qualified Stock Options Difference And Comparison Diffen

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

Non Qualified Stock Options Explained Plus What They Mean For Your Company S Taxes Warren Averett Cpas Advisors